For Parents

Board & Administration

Curriculum & Programming

Programs and Clubs

Guidance Counseling

Media Centers

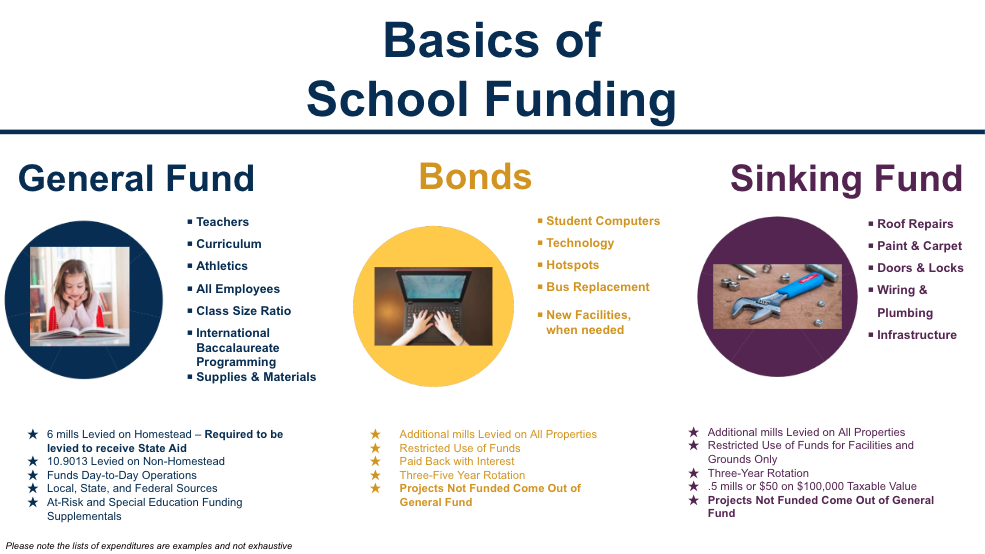

Routine Operational Millage & Recurring Technology and Transportation Bond Proposals

Special Election May 2, 2023

KEY FACTS

The millage proposal is a renewal of millage that Leland voters have approved/renewed annually for many years. It isn’t a new millage or a tax increase.

The millage is only levied on non-exempt, non-homestead property (commercial property, business, second homes, rental property).

Homestead property (primary homes) are exempt. Most voters probably haven’t paid the operating millage and won’t pay it in the future.

Levying 10.9013 mills is required for the district to receive full State funding.

If the millage isn’t renewed, the district would lose more than $4.5 million in operating funding for 2023-24, and each year thereafter unless and until the voters approve a renewal.

Operational Millage dollars pay for the normal operations of the school

Teacher salaries and all employee costs

Curricular materials and programming

Athletics

Activities, extra curricular activities

Classroom supplies and materials

Furniture

Routine upkeep and maintenance

Tech and Transportation Bond pays for:

School buses

One-one student and staff devices such as ipads and laptops

Technology infrastructure and equipment such as

Updated fiber cables

Switches

Wireless access points

Battery backups